The New Tax Law Will Impact All Foreigners

The New Tax Law Will Impact All Foreigners

外国人开始交税, 其实对中国学校也是有一些影响的, 那么学校就需要来了解一下税收政策了 ! 各位学校细细读来!

The article is split into the following parts:

Main changes in the new law

Who will be affected?

Tips

Different bank treatment

How to fill the tax form

1. 1.What are the new rules?

The most important impact comes from these 3 changes:

1. The government has the right to investigate foreigners via banks by tracking you via your transactions (ex. deposits, transfers or balances over RMB5000).

2. Banks automatically report any account with a balance over RMB5000in the name of a foreigner to be investigated.

Investigations include:

Where does the money come from (salary etc)

→ If deposits come from salary

→ Is the foreigner on the right visa?

3. The minimum tax threshold changed from RMB4800 to RMB5000 per month

Your bank has the right to freeze your account while you are being investigated, they also have the authority to keep the money.

The banks will forward all information to the Chinese Government and Chinese Tax Office and link it with your visa.

Be vigilant, China will be commencing a Nationwide crackdown on ALL FOREIGNERS as of 31. December!

2. 2. Who is affected?

All foreigners having a Chinese bank account (applies to any visa - workers, teachers, students,...)

Bank accounts having RMB5000+ will be automatically reported by the bank to the government.

Wechat / AliPay accounts with more than RMB5000.

3. Tips

TIP 1: If you keep your bank account below RMB5000 there is no investigation.

4. TIP 2: Wechat/ AliPay will be controlled as well (balance under RMB5000 will not be investigated).

TIP 3: If you are a teacher make sure your school helps you fill out the form!

If you are on a legal Z visa or FEC permit you can fill the form as a "Resident Tax Payer

If your school marks the "Resident Tax Payer" box it proves that

→ your school is actually paying tax from your salary; and

→ you have a legitimate work visa with FEC permit directly linked to your place of work, proving you are legitimate!

If your school tells you anything else you should definitely question your work permit!

6. Tip 4: Be careful if working for a Training Centre that deposits directly into your bank account - many training centers are not legal, do not pay tax and are known to hire foreigners illegally → foreigners have been caught, investigated and deported for this

7. 4. Different bank treatment

From a seemingly reliable foreign source, we know how BOC, HuaXia and ICBC approach the customers - here a short summary

1. Visit the branch where you opened the account.

2. Ask for a knowledgeable service person - not all are informed.

3. You need to fill out the tax form before transferring abroad (more on that below).

4. Don't expect the banks to inform you about the new law - Go and check by yourself.

5. Ask for a copy of the signed documents as they might not give it to you!

8. HuaXia Bank & ICBC are doing the tax registration automatically when registering an account - however, double check would be advisable.

9. BOC advises customers usually to do it online as it seems to be easier and less paperwork.

10. 5. How to fill the Tax Form?

11. Everyone will need to fill out the Tax Form before transferring larger amounts of money abroad (>RMB5000) – We already have reports of people being asked to fill out the form (even though it's not officially enforced until January).

There are 3 choices to register oneself:

1. Chinese Resident - Living and working here, paying tax in China but in no other country.

2. Non-Chinese Resident - Living and working/ studying here but not really paying tax - check with the person who assists you in the visa and employment process.

3. Select this one when living and working in China, paying tax in China and also paying tax in other countries.

If not given by your employer you can find the tax form at your bank. To fill it out you need:

Copy of the work contract

Copy of certificate of employment

copy of tax payment certificate

State if you pay taxes in another country as well.

接下来一年, 会很多外教在薪资问题上和学校讨论来讨论去。 看看这些, 学校也会受益很多。

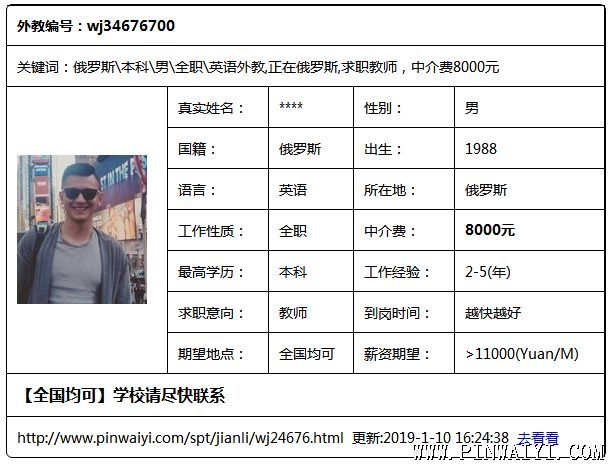

外教推荐:

小编推荐:城市招聘外教攻略

提交招聘需求

提交招聘需求